Welcomenational pension system

National Pension System (NPS) is a voluntary, defined contribution scheme that is introduced by the Government of India, with the objective of extending the old age financial security to all the citizens who opt for this scheme.National Pension System (NPS) is an easily accessible, low cost, tax-efficient, flexible and portable retirement savings account. NPS is a voluntary, defined contribution retirement savings scheme designed to enable the subscribers to make optimum decisions regarding their future through systematic savings during their working life. NPS seeks to inculcate the habit of saving for retirement amongst the citizens. It is an attempt towards finding a sustainable solution to the problem of providing adequate retirement income to every citizen of India.

Why Invest in National Pension System (NPS)?

frequently asked questions

-

National Pension System (NPS) is a government-sponsored pension scheme that was launched in the year 2004 by Pension Fund Regulatory and Development Authority of India (PFRDA) for Government employees only but was later made available to all the employees from Public sector, Private sector and even the unorganised sector w.e.f. 1st May 2009.

The objective of this scheme was to secure financial future of the individual after the retirement. Under NPS, the individual contributes to his / her retirement account and his/her employer (if applicable) can also co-contribute for the welfare of the individual.

-

An individual should opt for NPS for the following reasons:

- Confirmed annuity in their retirement life.

- Reduce post retirement dependency on others for livelihood

- Good returns in long term on their investment.

- Simple &hassle free process of enrollment.

- Entry age 18 to 70 years.

- Voluntary contribution

- Portable Investment.

- Various investment options available to cater to all risk appetites (i) Equity (ii) Govt Bonds (iii) Corporate Bonds (iv) Alternate Investment option.

- Tax benefits U/S 80 CCD – up to Rs. 50,000/-.

- Very low cost investment scheme.

- Partial withdrawal up to 25% after 3 years.

- Minimum Contribution 1000/- per year.

-

Yes. Investment in NPS is independent of one’s contributions or subscription to any Provident/Pension Fund.

-

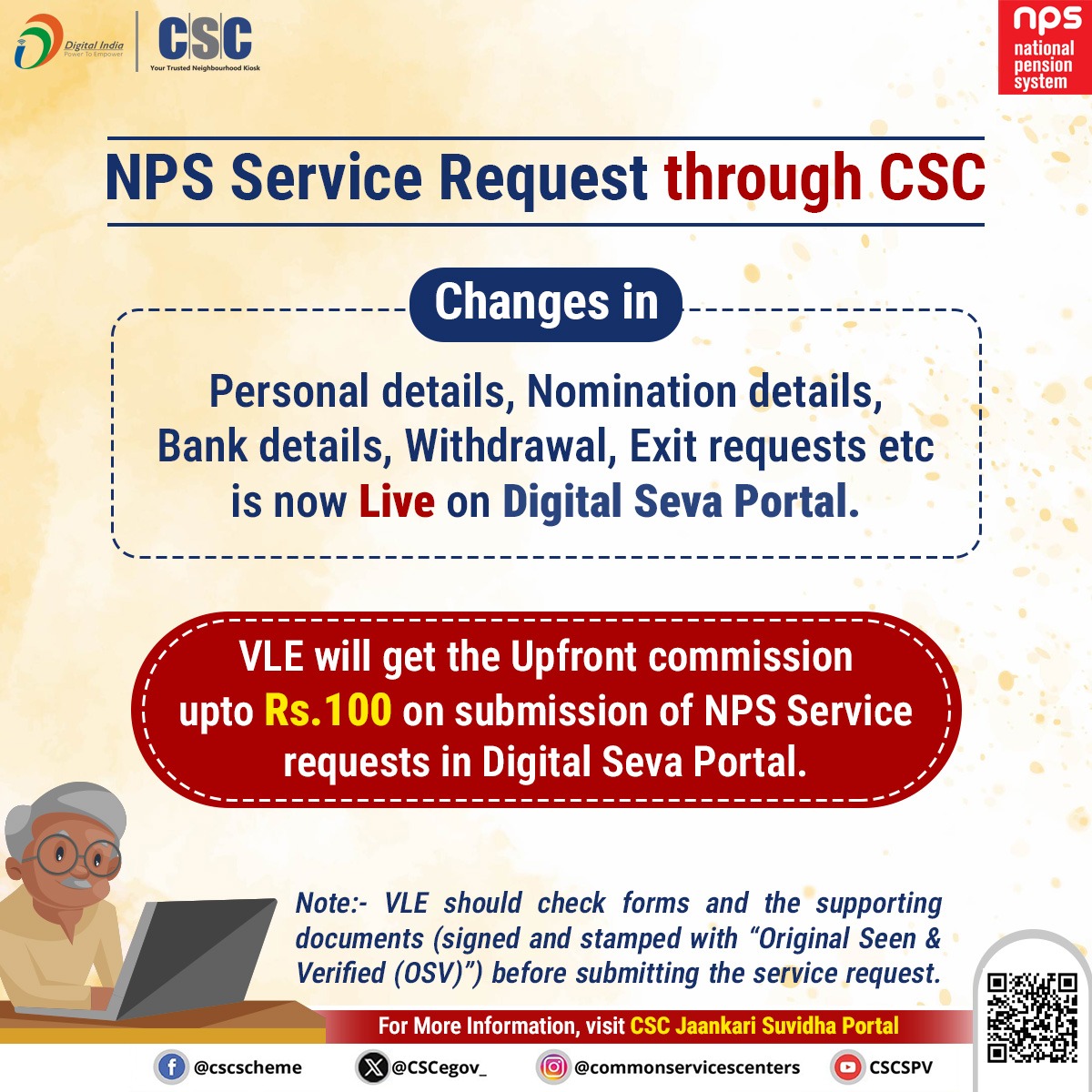

An individual citizen can open an NPS account through CSC e Governance Services India Limited registered by PFRDA.

-

The Government will not be making any contribution to your NPS account.

Fund Managers returns as on 25th October 2024

| SCHEME-E Tier-I | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 9 May 2017 | 1010.4 | 79674 | 27.7861 | 31.59% | 13.50% | 17.64% | 13.91% | NA | 14.66% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 2331.98 | 192821 | 14.2914 | 32.16% | NA | NA | NA | NA | 19.40% |

| HDFC Pension Fund Management Ltd. | 1 Aug 2013 | 46661.53 | 2187517 | 52.0011 | 33.10% | 13.29% | 18.30% | 14.67% | 13.64% | 15.80% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 18 May 2009 | 16960.48 | 882235 | 70.3096 | 33.76% | 14.20% | 18.78% | 14.74% | 13.31% | 13.46% |

| Kotak Mahindra Pension Fund Ltd. | 15 May 2009 | 2533.01 | 125263 | 64.8783 | 32.57% | 14.19% | 18.65% | 14.57% | 13.41% | 12.86% |

| LIC Pension Fund Ltd. | 23 Jul 2013 | 5896.6 | 446742 | 43.5828 | 30.64% | 13.41% | 17.98% | 13.52% | 12.25% | 13.96% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 443.6 | 35511 | 14.0516 | 32.14% | NA | NA | NA | NA | 17.40% |

| SBI Pension Funds Pvt. Ltd | 15 May 2009 | 18756.23 | 1828935 | 55.6242 | 28.37% | 12.40% | 16.90% | 13.47% | 12.53% | 11.74% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 1670.59 | 68582 | 15.246 | 35.84% | NA | NA | NA | NA | 21.28% |

| UTI Pension Fund Ltd. | 21 May 2009 | 2923.74 | 133127 | 70.8318 | 38.82% | 15.43% | 19.01% | 14.89% | 13.70% | 13.52% |

| DSP Pension Fund Managers Private Limited | 26 Dec 2023 | 374.66 | 10513 | 12.3329 | NA | NA | NA | NA | NA | 23.33% |

| SCHEME-C Tier-I | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 9 May 2017 | 568.3 | 79493 | 18.3172 | 9.94% | 6.59% | 7.67% | 7.96% | NA | 8.44% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 1461.96 | 189656 | 11.7127 | 9.54% | NA | NA | NA | NA | 8.17% |

| HDFC Pension Fund Management Ltd. | 1 Aug 2013 | 19543.33 | 2158548 | 27.238 | 10.02% | 6.68% | 7.90% | 8.02% | 8.96% | 9.32% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 18 May 2009 | 8048.22 | 866584 | 41.0549 | 9.73% | 6.44% | 7.41% | 7.72% | 8.87% | 9.57% |

| Kotak Mahindra Pension Fund Ltd. | 15 May 2009 | 1034.39 | 121888 | 39.3799 | 9.57% | 6.32% | 7.13% | 7.13% | 8.36% | 9.27% |

| LIC Pension Fund Ltd. | 23 Jul 2013 | 3259.04 | 446593 | 26.5052 | 9.45% | 6.21% | 7.51% | 7.59% | 8.64% | 9.04% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 288.29 | 34834 | 11.7048 | 9.40% | NA | NA | NA | NA | 7.71% |

| SBI Pension Funds Pvt. Ltd | 15 May 2009 | 9814.36 | 1820165 | 41.2179 | 9.83% | 6.40% | 7.51% | 7.73% | 8.70% | 9.60% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 814.81 | 64321 | 11.7172 | 10.00% | NA | NA | NA | NA | 7.52% |

| UTI Pension Fund Ltd. | 21 May 2009 | 1200.99 | 129195 | 36.477 | 9.66% | 6.33% | 7.52% | 7.38% | 8.42% | 8.74% |

| DSP Pension Fund Managers Private Limited | 26 Dec 2023 | 207.17 | 10215 | 10.7723 | NA | NA | NA | NA | NA | 7.72% |

| SCHEME-G Tier-I | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 9 May 2017 | 990.8 | 80149 | 17.9591 | 12.35% | 7.30% | 7.69% | 8.04% | NA | 8.16% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 1986 | 189941 | 11.9715 | 12.11% | NA | NA | NA | NA | 9.35% |

| HDFC Pension Fund Management Ltd. | 1 Aug 2013 | 32189.08 | 2144032 | 26.7985 | 12.49% | 7.14% | 7.73% | 8.12% | 9.03% | 9.17% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 18 May 2009 | 12932.52 | 860641 | 35.7113 | 12.07% | 6.96% | 7.49% | 7.89% | 8.93% | 8.59% |

| Kotak Mahindra Pension Fund Ltd. | 15 May 2009 | 1832.98 | 122019 | 35.713 | 12.10% | 7.11% | 7.55% | 7.97% | 9.01% | 8.58% |

| LIC Pension Fund Ltd. | 23 Jul 2013 | 6205.03 | 469132 | 28.9092 | 12.35% | 7.21% | 7.69% | 8.48% | 9.52% | 9.88% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 585.87 | 37456 | 12.119 | 11.97% | NA | NA | NA | NA | 9.49% |

| SBI Pension Funds Pvt. Ltd | 15 May 2009 | 19988.59 | 1834263 | 38.6949 | 12.39% | 7.11% | 7.53% | 7.98% | 9.06% | 9.15% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 1156.9 | 65490 | 12.0853 | 11.99% | NA | NA | NA | NA | 9.05% |

| UTI Pension Fund Ltd. | 21 May 2009 | 2175.84 | 128267 | 34.6074 | 12.41% | 7.32% | 7.42% | 7.80% | 8.74% | 8.37% |

| DSP Pension Fund Managers Private Limited | 26 Dec 2023 | 311.76 | 10324 | 11.0614 | NA | NA | NA | NA | NA | 10.61% |

| SCHEME-A Tier-I | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 15 May 2017 | 4.74 | 5325 | 16.0917 | 11.62% | 7.56% | 6.37% | 6.60% | NA | 6.59% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 2.1 | 9936 | 11.3966 | 6.96% | NA | NA | NA | NA | 6.71% |

| HDFC Pension Fund Management Ltd. | 10 Oct 2016 | 301.39 | 202456 | 19.523 | 13.92% | 8.93% | 8.56% | 8.75% | NA | 8.67% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 21 Nov 2016 | 70.59 | 74500 | 17.6267 | 15.72% | 7.66% | 6.80% | 7.13% | NA | 7.41% |

| Kotak Mahindra Pension Fund Ltd. | 14 Oct 2016 | 15.1 | 10458 | 17.5113 | 16.39% | 7.02% | 6.80% | 7.46% | NA | 7.22% |

| LIC Pension Fund Ltd. | 13 Oct 2016 | 22.11 | 25733 | 17.9526 | 10.08% | 6.90% | 7.15% | 7.77% | NA | 7.55% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 0.29 | 1289 | 9.9075 | 7.25% | NA | NA | NA | NA | -0.44% |

| SBI Pension Funds Pvt. Ltd | 13 Oct 2016 | 96.79 | 111183 | 20.0566 | 15.56% | 7.71% | 9.53% | 9.41% | NA | 9.04% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 5.57 | 5600 | 12.0687 | 11.72% | NA | NA | NA | NA | 8.98% |

| UTI Pension Fund Ltd. | 14 Oct 2016 | 13 | 9614 | 16.8386 | 14.48% | 6.74% | 6.55% | 6.73% | NA | 6.70% |

| DSP Pension Fund Managers Private Limited | 27 Dec 2023 | 0.51 | 601 | 10.536 | NA | NA | NA | NA | NA | 5.36% |

| SCHEME-E Tier-II | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 9 May 2017 | 42.03 | 17944 | 28.0392 | 32.97% | 14.04% | 18.01% | 14.08% | NA | 14.80% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 10.7 | 9774 | 14.4839 | 33.91% | NA | NA | NA | NA | 20.20% |

| HDFC Pension Fund Management Ltd. | 1 Aug 2013 | 1406.27 | 295017 | 44.9668 | 33.24% | 13.36% | 18.30% | 14.66% | 13.72% | 14.31% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 21 Dec 2009 | 566.47 | 114007 | 55.3839 | 32.33% | 14.04% | 18.73% | 14.74% | 13.30% | 12.21% |

| Kotak Mahindra Pension Fund Ltd. | 14 Dec 2009 | 136.58 | 27942 | 57.0711 | 32.51% | 14.25% | 18.48% | 14.47% | 13.35% | 12.42% |

| LIC Pension Fund Ltd. | 12 Aug 2013 | 159.73 | 75622 | 36.2853 | 30.17% | 13.16% | 17.91% | 13.32% | 12.12% | 12.18% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 2.22 | 3296 | 14.7843 | 30.84% | NA | NA | NA | NA | 20.25% |

| SBI Pension Funds Pvt. Ltd | 14 Dec 2009 | 593.03 | 273009 | 52.4707 | 31.04% | 13.20% | 17.42% | 13.85% | 12.79% | 11.79% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 71.58 | 17557 | 15.2229 | 35.75% | NA | NA | NA | NA | 21.19% |

| UTI Pension Fund Ltd. | 14 Dec 2009 | 107.73 | 29514 | 55.9645 | 34.29% | 13.85% | 18.33% | 14.51% | 13.42% | 12.28% |

| DSP Pension Fund Managers Private Limited | 27 Dec 2023 | 5.26 | 1777 | 12.0287 | NA | NA | NA | NA | NA | 20.29% |

| SCHEME-C Tier-II | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 9 May 2017 | 17.15 | 17660 | 17.6979 | 10.13% | 6.65% | 7.66% | 7.81% | NA | 7.94% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 3.42 | 9280 | 11.5352 | 9.30% | NA | NA | NA | NA | 7.35% |

| HDFC Pension Fund Management Ltd. | 1 Aug 2013 | 514.64 | 284173 | 25.4574 | 9.92% | 6.59% | 7.70% | 7.88% | 8.61% | 8.67% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 21 Dec 2009 | 222.3 | 109721 | 38.0057 | 9.68% | 6.40% | 7.37% | 7.62% | 8.76% | 9.40% |

| Kotak Mahindra Pension Fund Ltd. | 14 Dec 2009 | 49.88 | 26904 | 34.2547 | 9.25% | 6.12% | 7.20% | 7.29% | 8.37% | 8.63% |

| LIC Pension Fund Ltd. | 12 Aug 2013 | 87.43 | 75738 | 25.1499 | 9.36% | 6.15% | 7.94% | 7.74% | 8.62% | 8.57% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 1.33 | 2916 | 11.8528 | 10.50% | NA | NA | NA | NA | 8.35% |

| SBI Pension Funds Pvt. Ltd | 14 Dec 2009 | 268.95 | 270649 | 36.8755 | 9.82% | 6.09% | 7.19% | 7.37% | 8.45% | 9.17% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 13.1 | 15350 | 11.8186 | 9.98% | NA | NA | NA | NA | 7.94% |

| UTI Pension Fund Ltd. | 14 Dec 2009 | 37.83 | 28690 | 34.8182 | 9.45% | 6.25% | 7.38% | 7.37% | 8.37% | 8.75% |

| DSP Pension Fund Managers Private Limited | 27 Dec 2023 | 0.78 | 1530 | 10.8878 | NA | NA | NA | NA | NA | 8.88% |

| SCHEME-G Tier-II | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Aditya Birla Sun Life Pension Management Ltd. | 9 May 2017 | 33.49 | 17513 | 17.2397 | 12.19% | 7.19% | 7.54% | 7.90% | NA | 7.56% |

| Axis Pension Fund Management Limited | 21 Oct 2022 | 5.66 | 9235 | 11.7981 | 11.73% | NA | NA | NA | NA | 8.56% |

| HDFC Pension Fund Management Ltd. | 1 Aug 2013 | 780.86 | 280851 | 27.1314 | 12.48% | 7.11% | 7.50% | 7.98% | 8.89% | 9.29% |

| ICICI Pru. Pension Fund Mgmt Co. Ltd. | 30 Dec 2009 | 343.17 | 107364 | 34.2269 | 11.95% | 6.99% | 7.51% | 7.89% | 8.93% | 8.65% |

| Kotak Mahindra Pension Fund Ltd. | 14 Dec 2009 | 84.66 | 26600 | 32.9774 | 11.89% | 7.06% | 7.40% | 7.70% | 8.83% | 8.35% |

| LIC Pension Fund Ltd. | 12 Aug 2013 | 258.4 | 79443 | 29.381 | 12.32% | 7.26% | 7.62% | 8.80% | 9.58% | 10.09% |

| Max Life Pension Fund Management Limited | 12 Sep 2022 | 1.41 | 2839 | 11.7974 | 10.05% | NA | NA | NA | NA | 8.11% |

| SBI Pension Funds Pvt. Ltd | 14 Dec 2009 | 560.05 | 272149 | 36.7134 | 12.42% | 7.10% | 7.44% | 7.87% | 8.96% | 9.14% |

| Tata Pension Management Pvt. Ltd. | 19 Aug 2022 | 18.93 | 15312 | 12.1333 | 11.75% | NA | NA | NA | NA | 9.25% |

| UTI Pension Fund Ltd. | 14 Dec 2009 | 74.27 | 28646 | 35.3872 | 12.02% | 7.20% | 7.33% | 7.74% | 8.77% | 8.87% |

| DSP Pension Fund Managers Private Limited | 27 Dec 2023 | 1.44 | 1502 | 10.7839 | NA | NA | NA | NA | NA | 7.84% |

| SCHEME-NPS Lite | ||||||||||

| Pension Fund | Inception Date |

AUM (Rs Crs) |

Subscribers | NAV | Returns 1 Year |

Returns 3 Years |

Returns 5 Years |

Returns 7 Years |

Returns 10 Years |

Returns Inception |

|---|---|---|---|---|---|---|---|---|---|---|

| Kotak Mahindra Pension Fund Ltd. | 30 Jan 2012 | 92.55 | 22387 | 32.6445 | 14.01% | 7.94% | 9.08% | 8.54% | 9.29% | 9.73% |

| LIC Pension Fund Ltd. | 4 Oct 2010 | 1735.1 | 2629740 | 37.5146 | 13.36% | 7.63% | 9.00% | 8.72% | 9.43% | 9.85% |

| SBI Pension Funds Pvt. Ltd | 16 Sep 2010 | 2390.21 | 3321961 | 37.4868 | 13.35% | 7.68% | 8.85% | 8.54% | 9.39% | 9.81% |

| UTI Pension Fund Ltd. | 4 Oct 2010 | 1701.03 | 2629765 | 37.2839 | 13.71% | 7.64% | 8.96% | 8.55% | 9.36% | 9.81% |